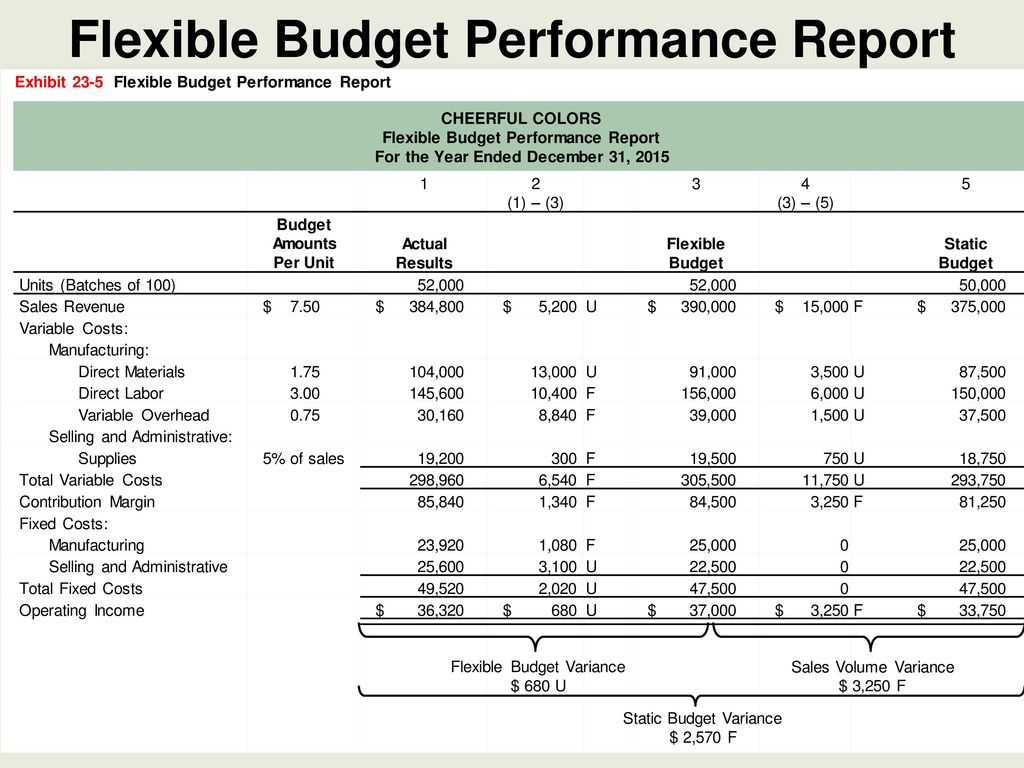

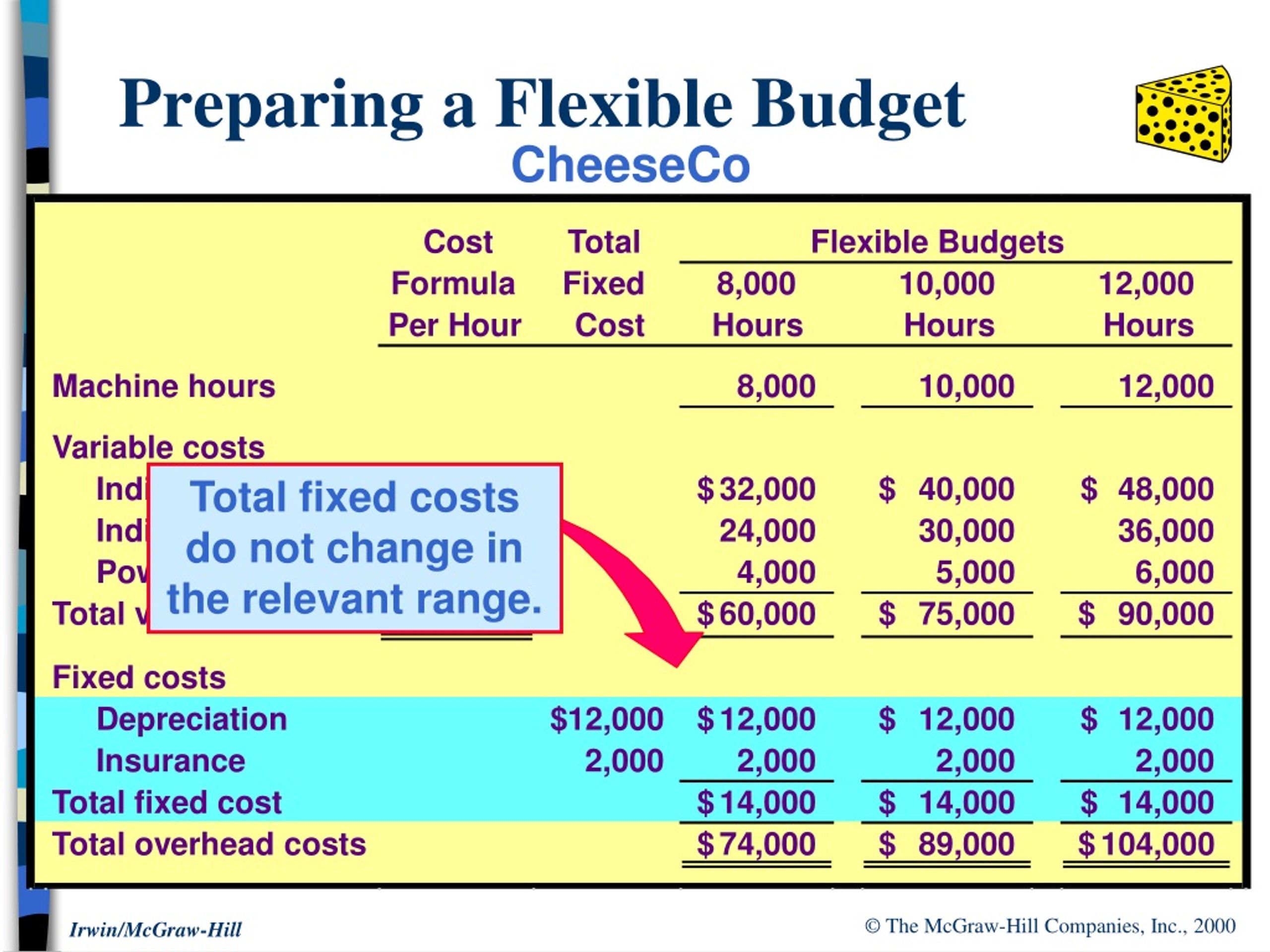

They take into account that a business is an organic, growing system and that life is not predictable. Without psychic abilities, how can you guarantee what your costs will be six months from today? Will your business be impacted by weather, technology, or a worldwide pandemic? Who knows!įlexible budgets work by taking the pressure off to predict future happenings.Ĭreating a flexible budget begins with assigning all static costs a fixed monthly value, and then determining the percentage of revenue to assign to your variable costs.įlexible budgets are dynamic systems which allow for expansion and contraction in real time. How Does a Flexible Budget Work?Īccepting that we can’t predict the future, as hard as we might try, is a lesson everyone learned in recent years. This allows for a more symbiotic relationship between the two. Due to the ability to make real-time adjustments, the results present great detail and accuracy at the end of the year.Īfter each month (or set period) closes, you compare the projected revenue against the actual revenue and adjust the next month’s expenses accordingly.

This allows for budget adjustments to occur in real-time, taking into account external factors.Įven if a cost is assigned a numerical value, a monthly review of costs compared to revenue allows that number to be changed for future periods.Ī flexible budget, while much more time-intensive to create and maintain, offers an incredibly precise picture of your company’s performance. Layered on top of that is a flexible budget system allowing for variable costs to fluctuate based on sales performance.Ī flexible budget often uses a percentage of your projected revenue to account for variable costs rather than assigning a hard numerical value to everything. It begins with a static framework built from the costs that are not anticipated to change throughout the year.

The more sophisticated relative of the static budget model, a flexible budget allows for change, and as we’ve said – business can be unpredictable.Ī flexible budget is kind of a hybrid approach to financial planning.

0 kommentar(er)

0 kommentar(er)